A risk-based capital (“RBC”) solvency regime commenced for Hong Kong insurers last summer, replacing a previous solvency regime based on solvency margin, with insurers required to maintain assets in excess of liabilities.

The purpose of this RBC regime is, on one hand, to ensure insurers maintain sufficient capital to withstand adverse financial shocks or other risks, and, on the other hand, to allow for the efficient and effective deployment of their financial resources for business growth and policyholder protection.

Since RBC came into effect on 1 July 2024, this approach aims to safeguard the stability of the insurance sector while minimising undue constraints on insurers’ operations.

Essentially, RBC adopts a risk-based approach which aims to align capital requirements of an insurer with its specific risk profile. Insurers with higher risk exposure are required to hold more capital.

To achieve this, RBC adopts a three-pillar framework.

The three-pillar framework

Pillar 1

Capital requirements: quantity

Pillar 1 refers to quantitative requirements, namely the capital an insurer is required to hold. Insurers must ensure their capital base is not less than each of the prescribed capital amount (“PCA”), minimum capital amount and HK$20 million.

PCA is determined by aggregating risk capital amounts for each “risk module” – market risk, life insurance risk, general insurance risk, counterparty default and other risk and operational risk – and sub-risk modules. In determining the PCA, Hong Kong’s Insurance Authority (IA) ensures an insurer has sufficient assets to cover liabilities with a 99.5% probability within a year.

In other words, the PCA is set at a level that enables an insurer to absorb the impact of a 1-in-200-year adverse event and remain solvent.

The Minimal Capital Amount is determined as 50% of the PCA, unless relaxed or varied by the IA on a case-by-case basis.

An insurer must notify the IA if its capital base falls below or is at risk of falling below any of the amount. Failure to notify can constitute an offence with a fine of up to HK$200,000. Non-compliance with the capital requirements provides grounds for the IA to revoke the insurer’s authorisation.

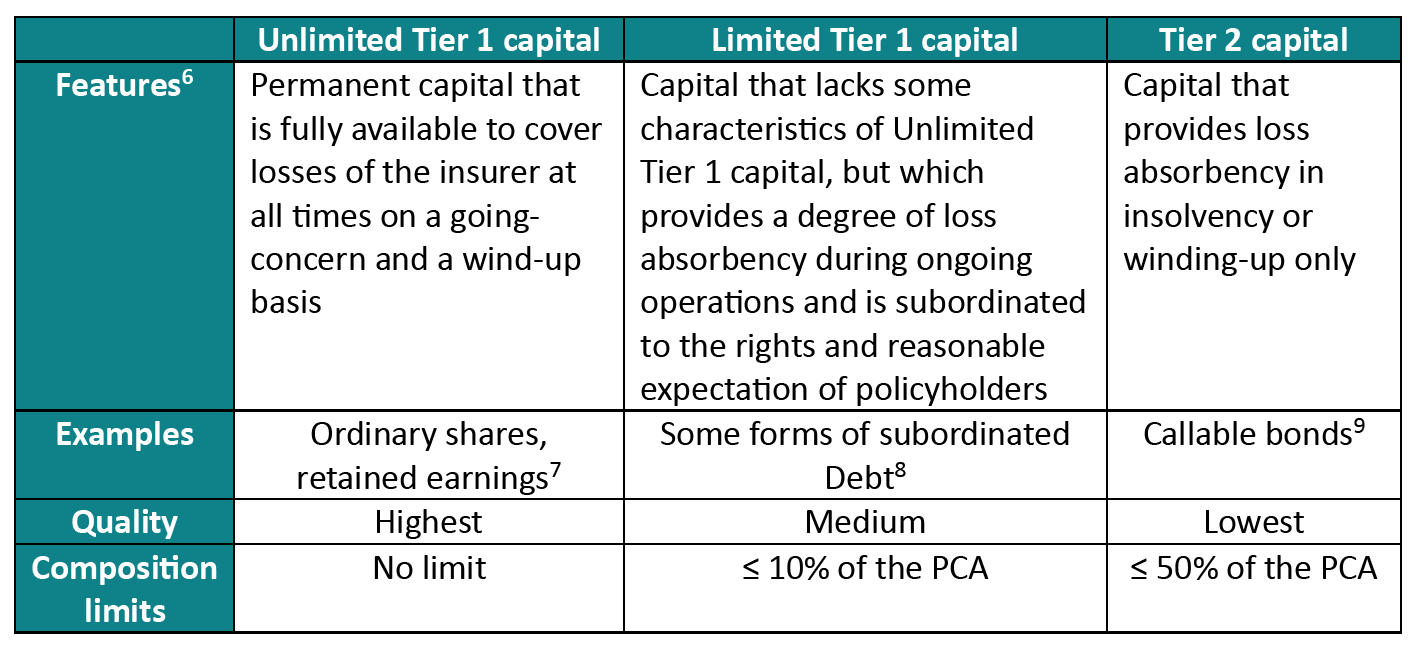

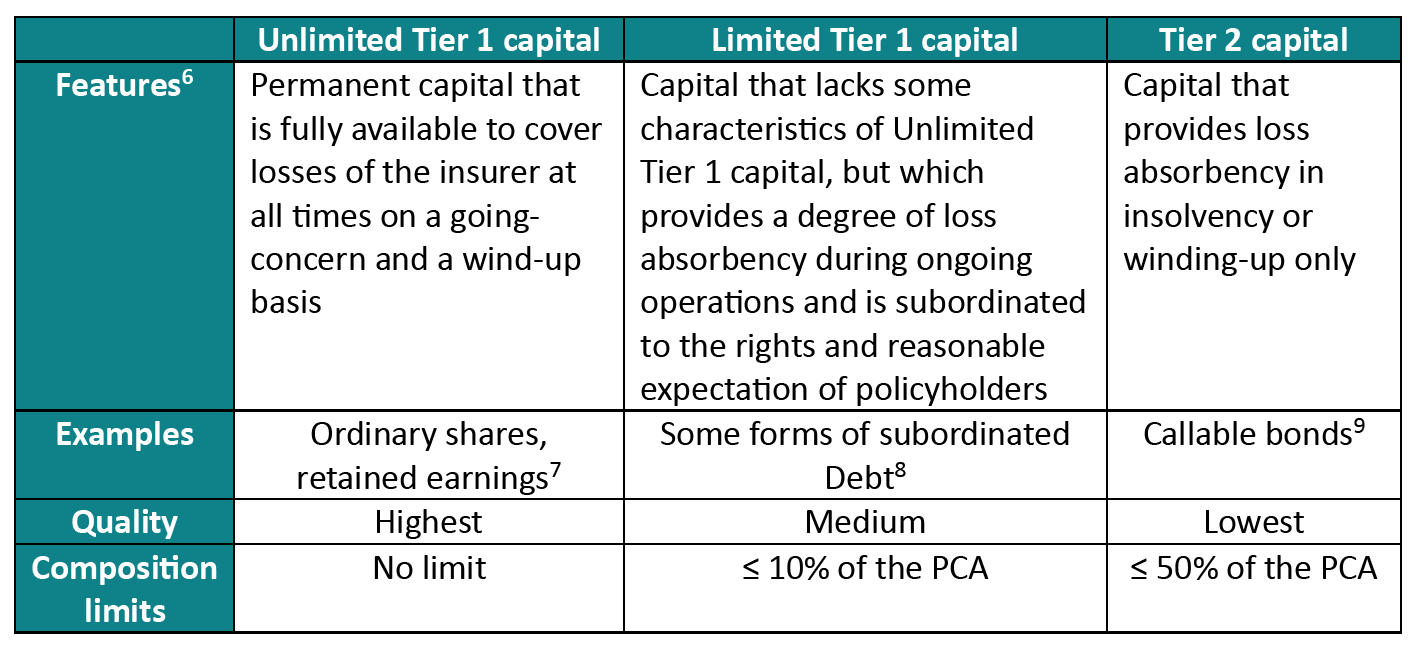

Not all types of capital are equal – Quality and valuation basis of capital requirements

In calculating the capital base, not all forms of capital offer the same level of resilience for insurers to withstand adverse financial shocks, despite having the same nominal value.

For instance, retained earnings – being readily available and largely retaining their value even during market downturns – are considered the highest quality capital and classified as “Unlimited Tier 1 capital”. Conversely, instruments like callable bonds may present challenges in realising their value during a financial crisis. Consequently, they are categorised as lower quality “Tier 2 capital”.

To ensure they have sufficient high-quality capital to withstand market turmoil, insurers are required to constitute their capital base with more Tier 1 capital and less Tier 2 capital, as set out in the table below:

Please click on the superscript numbers , , , for details of the corresponding remarks in the table.

View the table in actual size

For any instrument other than ordinary shares, independent legal opinion and independent accounting opinion are required to confirm that the capital instrument meets the conditions of the intended tier of capital.

To arrive at the capital base, deductions must be made to remove any assets or capital components whose value is uncertain, or availability to absorb losses across the entire company is restricted.

Key deductions include:

- Holdings relating to regulated financial entities: To prevent the same capital from being counted multiple times within a financial group, an insurer’s holdings in its non-consolidated subsidiaries or affiliates that are themselves regulated financial entities will be deducted. This ensures that the capital reported by the insurer is genuinely its own and not dependent on capital that is already supporting risks in another regulated entity.

- Encumbered assets: An asset is encumbered if it is pledged as collateral or is otherwise not freely available to meet the claims of all policyholders. An example is assets designated for guaranteeing the reserves of an overseas branch, as required by another regulator.

- Negative reserves: For some long-term insurance contracts, the present value of future premiums can exceed the present value of future benefits and expenses. This difference in value is economically an asset. However, since the realisation of this value depends on the future collection of premiums, it is considered too uncertain to be fully counted as high-quality capital. The framework requires that negative reserves (in excess of the PCA) be deducted from Unlimited Tier 1 capital and adjusted to Tier 2 capital.

Capital requirements for marine insurers and captive insurers as well as Lloyd’s are separately prescribed in Insurance (Marine Insurers and Captive Insurers) Rules (Cap 41U) and Insurance (Lloyd’s) Rules (Cap 41V).

Pillar 2

Pillar 2 focuses on corporate governance and enterprise risk management, complementing the quantitative capital rules of Pillar 1 and the disclosure requirements of Pillar 3.

The IA has issued a Guideline on Enterprise Risk Management (“ERM”), which came into effect on 1 January 2020. The core of the guideline is to foster a strong risk culture within the insurance industry, with the Board of Directors and senior management taking ownership. It sets out a principles-based framework for insurers to proactively identify, assess, monitor and manage their risk exposures.

Key components of the ERM framework under Pillar 2 include:

- Governance: Establishes clear roles and responsibilities for the Board, a Risk Committee and senior management in overseeing the ERM framework, with the ultimate ERM responsibility on the Board.

- Risk appetite statement: Requires insurers to define the level and types of risk they are willing to assume to achieve their business objectives.

- Risk assessment and control process: This involves the regular identification, quantification, monitoring and reporting of all foreseeable and material risks. This process should be forward-looking and embedded into the insurer’s business activities.

- Own risk and solvency assessment (“ORSA”): A crucial element of Pillar 2, the ORSA is a regular self-assessment of the insurer’s overall risk profile, current and future solvency, and liquidity positions. The guideline mandates that authorised insurers conduct an ORSA at least annually and submit an ORSA Report to the Insurance Authority.

The guideline also details various voluntary risk management policies that can be embedded within an insurer’s business activities, covering areas such as underwriting, asset-liability management, investment, reinsurance, liquidity and operational risks like cyber and conduct risk.

Pillar 3

Pillar 3 relates to regulatory reporting obligations to the IA regulator and public disclosure requirements.

Under the Insurance (Submission of Statements, Reports and Information) Rules (Cap 41S), authorised insurers are required to submit specified information to the IA. This includes financial statements prepared in accordance with generally accepted accounting principles, regulatory returns compiled under the Insurance Ordinance (Cap 41), auditor’s reports on those returns, and actuarial investigation or review reports. The Rules also outline the submission timelines, frequency and approved methods.

Instructions regarding regulatory returns and list of required forms comprising the regulatory return can be found here.

The IA launched a public consultation on draft rules for the implementation of public disclosure requirements under Pillar 3 in March 2025. We will continue monitoring the regulatory updates under Pillar 3.

Key takeaway

RBC brings a new era of regulation for the Hong Kong insurance industry – enhancing financial stability by better aligning capital requirements with actual risks involved, for better protection of policyholders. This aligns insurance regulation with international standards and promotes Hong Kong as a global and regional insurance hub.