Part 4: Key developments in the enforcement of monopoly agreements

1. Monopoly agreement cases (2024 to Q1 2025)

1.1 Overview of monopoly agreement enforcement

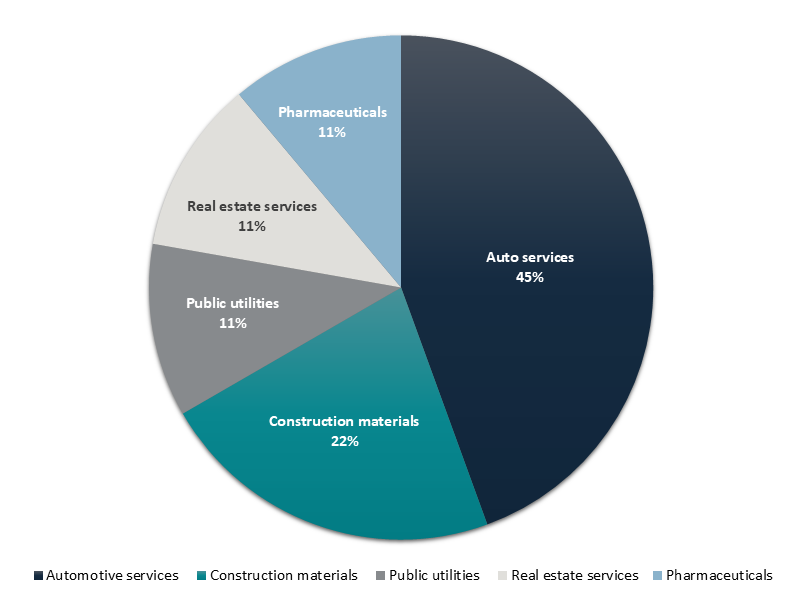

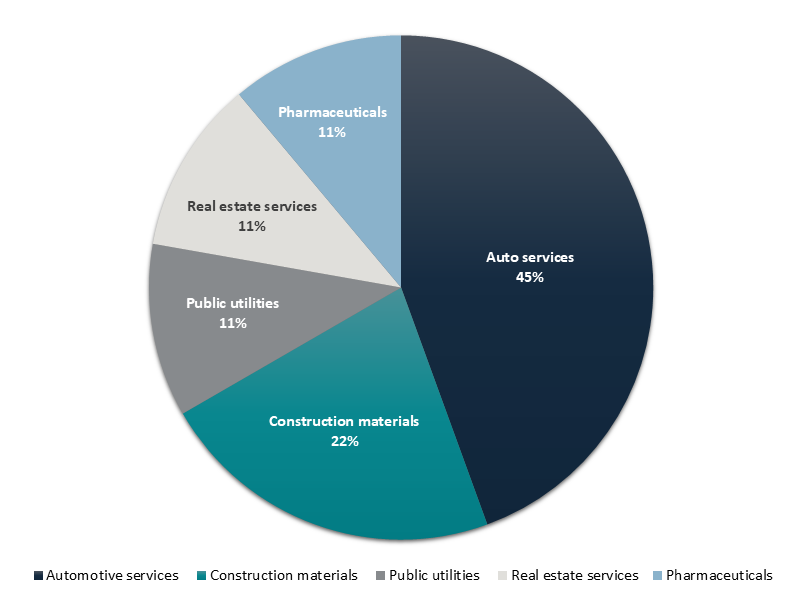

From 2024 to Q1 2025, the SAMR published nine decisions on monopoly agreements, covering sectors such as automotive services, real estate, construction materials, public utilities and pharmaceuticals.

Figure 1: Sector distribution of monopoly agreement cases (2024 – Q1 2025)

Source: SAMR’s website

1.2 Key takeaways from monopoly agreement cases during this period

- Hefty fines & personal liability: Total fines of approximately RMB 236 million, with ringleaders fined up to 10% of last year’s sales. Entities without prior-year sales were still fined.

Notably, a fine of RMB 500,000 was imposed on an individual cartel organiser in Q1 2025 signalled personal liability risks for employees facilitating collusion.

This underscores the growing importance of strong compliance programmes and employee training.

- Leniency opportunities: Proactive cooperation with the investigation can reduce fines. The first whistleblower can receive full immunity, or at least an 80% reduction in fine.

Even after investigation begins, an 80% fine reduction is possible if the whistleblower provides material evidence undiscovered by the authorities (Xinjiang Rock Wool Case).

- Localised markets under scrutiny: Most cases involved industries such as automotive inspection, construction materials, real estate appraisal and public utilities. These are local markets with limited competition, high transparency and frequent interaction – for example, through trade associations – which makes them prone to collusion. Expect increased enforcement focus in these sectors.

- Common violations: All cases involved price fixing, often paired with market sharing and output restrictions. Notably, oral agreements and disguised mechanism (e.g. using a JV) are now enforcement targets.

- Trade associations – a hotspot for antitrust risks: Two of the nine cases involved trade associations, underscoring their potential role in facilitating collusion. This aligns with the 2024 Antitrust Guidelines for Industry Associations, which bans associations from organising or assisting monopolistic agreements.

To reduce legal risk, companies should avoid sharing sensitive business information – such as prices, output or market plans – during association meetings or activities.

- Pharmaceuticals in focus: The Shanghai Pharma Case alone accounted for over RMB 223 million in fines, accounting for 94% of total fines from 2024 to Q1 2025. Follow our Tanglau pharmaceutical series for deeper insights.

2. Going forward

In Part 5, we will examine enforcement actions taken by Mainland Chinese competition regulators in abuse of dominance cases – with a focus on the first such case in the financial data sector.

Before we dive in, consider these important questions:

- What industries are currently in the spotlight for abuse of dominance investigations?

- How did the regulator determine that leveraging access to essential data constituted abuse in the financial data sector?

- What are the key takeaways from this landmark case in the financial data sector?

To support your understanding, we include an appendix listing cartel cases from 2024 to Q1 2025, offering practical reference points as you navigate this legal update.